If you’re new to accepting credit cards, merchant processing can be very confusing. Let’s take a step-by-step look at a typical retail credit card transaction…

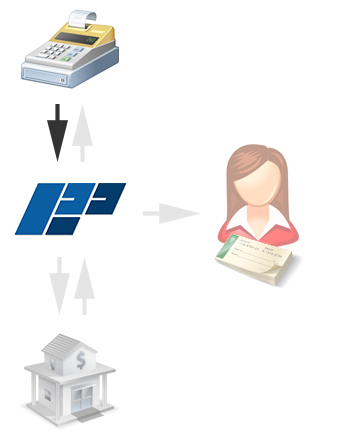

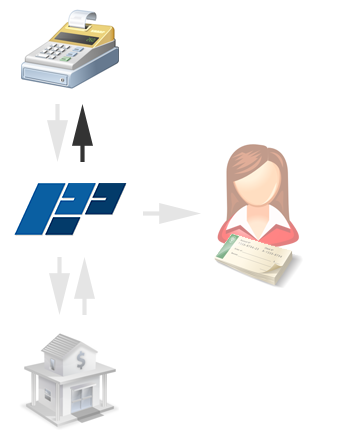

Step 1

The merchant or customer slides their payment card card through the credit card terminal and enters the sale amount. The terminal securely connects to Premier’s gateway for authorization.

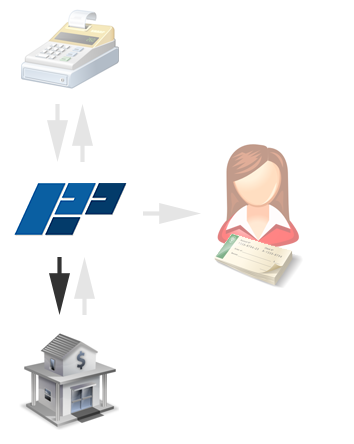

Step 2

Our gateway passes transaction data to the bank that issued the credit card and the bank checks to see if the card is valid and confirm that the charge amount is available on the card.

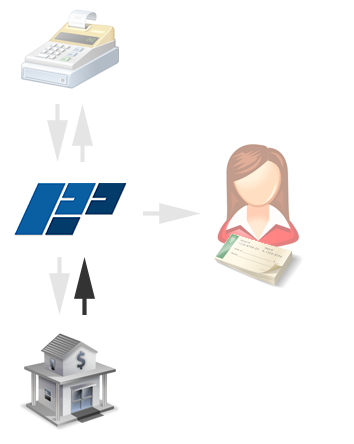

Step 3

The issuing bank sends back an approval number or a decline message which is received and processed by Premier Payments’ gateway.

Step 4

The information is passed back to the credit card terminal which prints a receipt for the customer to sign.

It takes approximately 12-15 seconds to complete steps 1-4 on a credit card machine using a phone line. The newer internet enabled machines can cut this time to just a few seconds.

Step 5

The merchant will then “settle” or “batch out” their terminal which begins the final process of the transaction.

In most cases Premier can automatically settle the transactions at a specified time each day. Once the settlement process is initiated the funds are transferred from the card issuing bank and are electronically deposits them into the merchant’s checking account.

Mobile & Wireless

Our mobile payment solutions feature a virtual point-of-sale payment application that conveniently processes real-time credit card transactions anywhere there’s Wi-Fi, Edge or 3G network.

Premier Mobile is provided as a free application available to all merchant customers and there are no expenses associated with a wireless terminal and no gateway or cellular access fees.

Merchants are discovering the benefits of having the capability to accept credit cards through a smartphone, tablet or other mobile device. The flexibility of accepting remote payments seamlessly and securely through a portable device allows your sales efforts to extend far beyond your traditional retail store, whether that be a physical space or on the Internet.

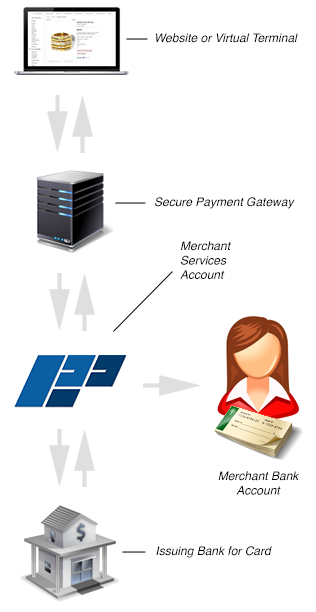

eCommerce, MOTO & Online

In order to accept credit and debit cards online through your eCommerce website or virtual terminal, you need both a secure merchant account and a payment gateway.

Merchant Account

The merchant account verifies credit card and customer information. This includes checking to see if the details supplied are correct (address, card number etc.) and if the card has been reported stolen, or has enough funds.

Typically, the bank will include setup charges, monthly or annual fees, monthly charge for a virtual terminal for you to process card details over the phone. You will also be charged a percentage of each transaction which they process, you may have a minimum monthly volume of business imposed, and in some cases you will have to provide a substantial bond or deposit as extra security.

Payment Gateway

A payment gateway is separate and acts as an intermediary between your website and all the banking systems. This is a seamless process and your customer does not interact with the gateway. The credit card and customer details are submitted via the gateway, which securely sends the information through the relevant financial networks to the merchant account.

Because you need both a merchant account and a payment gateway to process payments online, people often have to find these seperately. This means you may well end up paying two lots of set-up charges, monthly charges, and, worst of all, two lots of fees on every transaction.